|

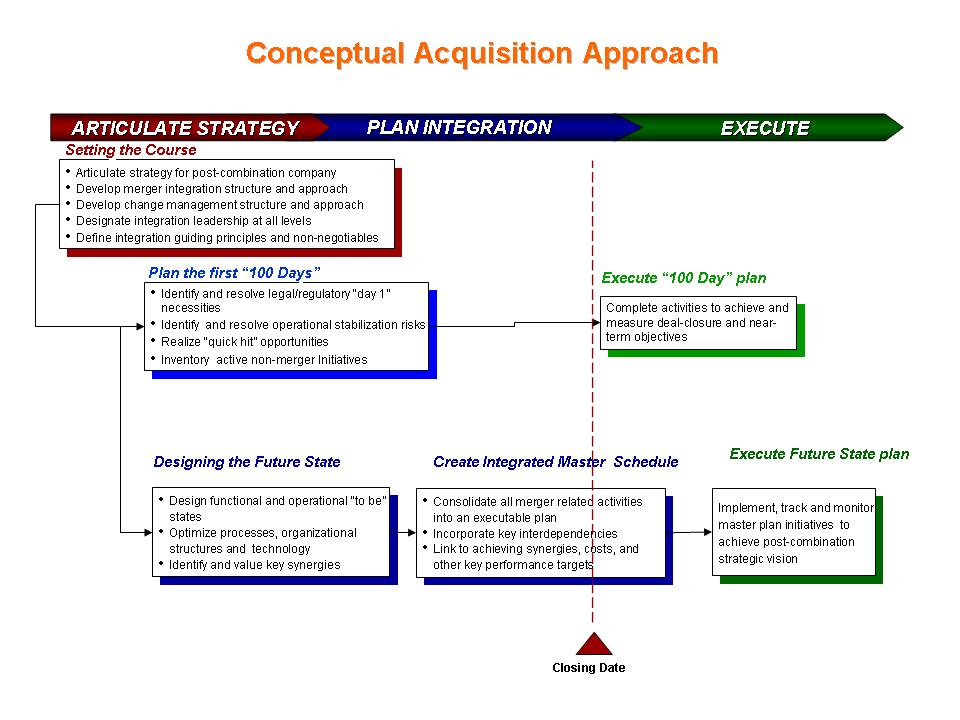

The following schematic outlines the broad phases for planning and executing a successful integration of an acquired company. We can assist in organizing and directing these efforts.

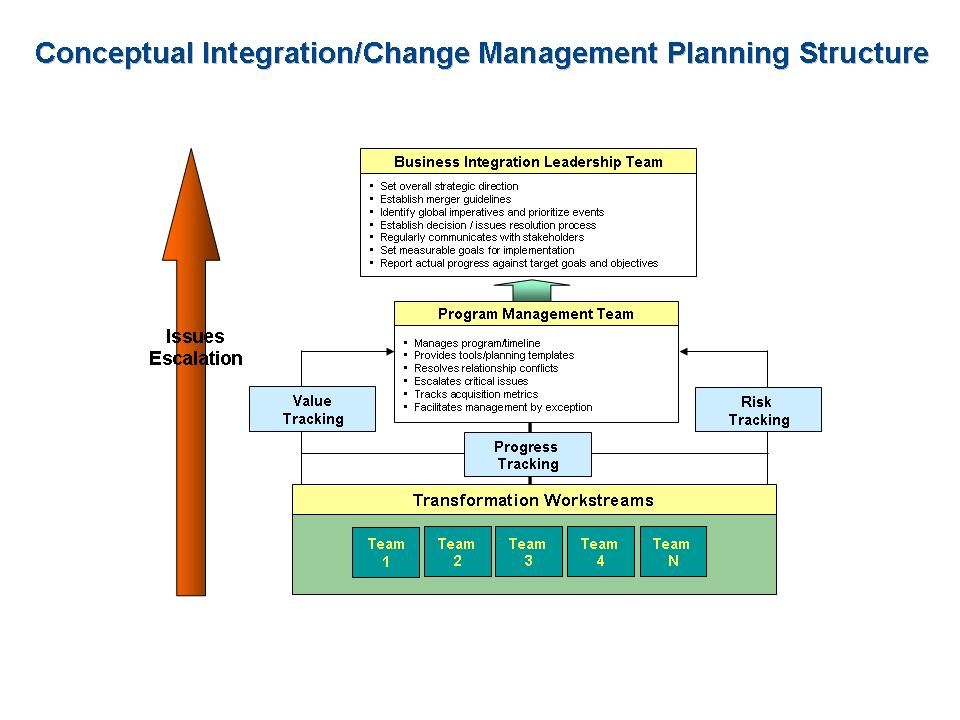

A key element is the establishment of an appropriate structure to assist in directing, tracking and reporting on progress. This is depicted in the following schematic.

Often some of the key benefits of an acquisition are closely related to the successful integration of the acquirer and target and the various synergies expected to be realized from the merged enterprises. As noted on the Corporate Merger and Acquisitions’ discussion, Insight’s view is that integration analysis and planning should take place early in the M&A process. An initial view of the complexities of the integration process unique to each situations should be undertaken during basic diligence, followed by more exhaustive planning and execution later in the diligence process, prior to close and then at close and thereafter.

For example, how will the sales organizations be aligned or combined, how will customers be served and by who? How will the advantages of combined post merger procurement process be achieved? How will the IT requirements of the new larger enterprise be met? How and when will the human resource plans be merged and managed? What are the expected synergies and how will they be accomplished and measured?

In cases where the buyer is a financial buyer and the acquisition is not an operating entity merger, there are the same sort of “change management” issues that usually must be addressed efficiently in order for the buyer to achieve their expected enhancements in performance. This is an especially important consideration when the entity being acquired is a subsidiary of a larger entity and may not have a complete set of stand alone operating capabilities. Often a transition services arrangement will be agreed by buyer and seller and the buyer must manage towards autonomy over a defined period.In addition to considering integration matters during diligence, we have served as the project management team on numerous engagements to assist our clients with their integration planning and execution. Most usually we undertake these assignments as an extension of the diligence efforts but on occasion we have been brought in late in the diligence process when the client has accomplished their primary diligence on their own and then realizes the challenges in managing the integration process.

While integration planning and execution are required for mergers and acquisitions for buyers, a subset of the issues are faced on the seller’s side in a corporate divestiture. For example, there needs to be careful communications with various stakeholders such as customers and vendors, financing sources, separation of human resource and insurance plans and technology services. Our personnel have substantial experience in providing project management guidance and leadership to our seller clients in such circumstances.

For a listing of representative transactions please click here.

Insight Consulting LLC

|