|

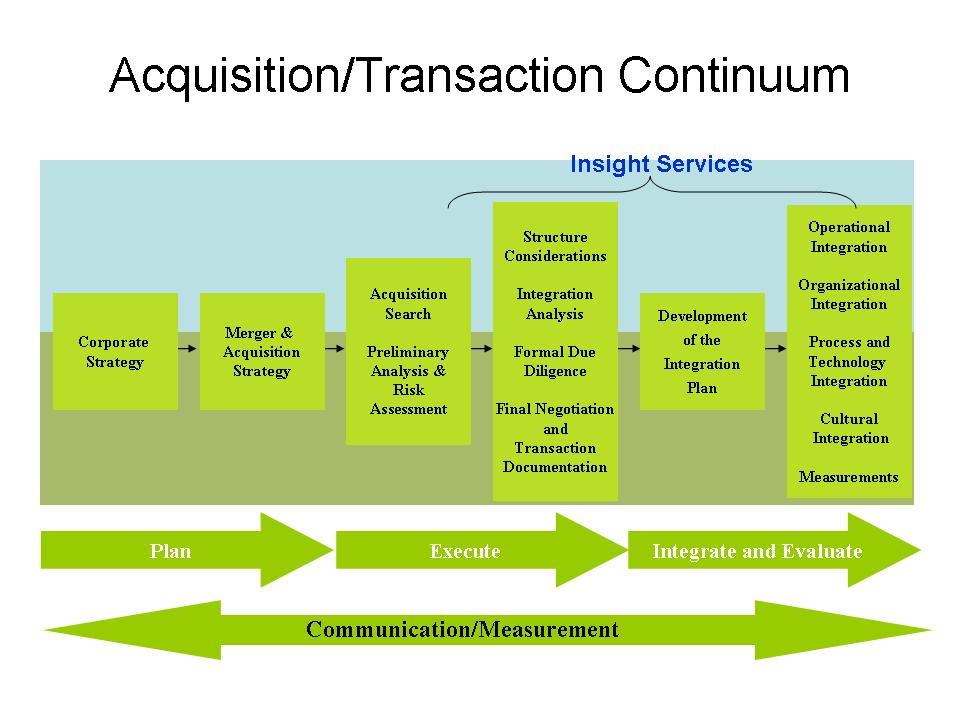

The following graphic depicts our view of the M&A continuum and identifies areas where Insight provides services

Mergers and acquisitions can be great vehicles for promoting a company’s growth or investment strategy. Unfortunately, they can also prove to be a costly, and emotionally wrenching, experience.

What makes the difference between a successful transaction and one that fails to prosper as anticipated during the underwriting process after the initial excitement of a completed transaction?

Much of the answer lies in taking an integrated, holistic approach to evaluating and planning your merger or acquisition, in looking beyond the current managerial environment and the financial numbers, to the full array of issues that will impact the success – or failure – of the transaction. This process includes the identification of change opportunities and, especially in the case of strategic buyers, synergies and integration. Insight manages functionally integrated diligence teams coordinating various skill sets to address the unique needs and risks/opportunities for each potential transaction Our professionals can help ensure that your transaction will be evaluated smoothly and if consummated will have the foundation to allow for the opportunity to achieve the expected benefits and costs.

Equipped with a deep knowledge of the technical aspects of numerous transactions in vastly differing situations and industries and extensive hands-on experience, we assist clients in going beyond the limited evaluation of just the numbers that is common in most due diligence approaches. The scope of our services has been as varied as the transactions in which we have been involved. Each situation and client needs mandate a unique application of services. For example, on some engagements we have been asked to manage most of the diligence process whereas on others we have performed narrow scope financial diligence in conjunction with an integrated team lead by others. In several cases where an investment banking firm was involved, we assisted our client in interviewing and hiring the investment banker and in “running interference” between our client and the bankers.For a listing of representative transactions please click here.

Insight Consulting LLC

|